tax deferred exchange definition

Handling earnest money deposits in a 1031 Exchange. If you own investment property and are thinking about selling it and buying another property you should know about the 1031 tax-deferred exchange.

Irc 1031 Exchange 2021 Https Www Serightesc Com

A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset.

. And what exactly does that mean. You must also identify your replacement property and complete the exchange within a specific time frame. Any income that one earns but does not receive until a later date resulting in a situation in which taxes on the income are not paid until later.

The deferred 1031 exchange gives you time by allowing you to sell your first property to an intermediary who then buys the property on the other end of the exchange at a later date. This property exchange takes its name from Section 1031 of the Internal Revenue Code. Like-kind property When two properties belong to the same category or type theyre called like-kind.

A tax-deferred exchange also referred to as a like-kind exchange a 1031 exchange a threeparty exchange or a Starker exchange may provide a way for you to take that 26000 apply it to the rental house purchase and delay the payment of the capital gains tax until you sell the new property. The first is income in certain retirement accounts. A deferred or reverse exchange thereby disqualifying the transaction from Section 1031 deferral of gain.

Those taxes could run as high as 15 to 30 when state and federal taxes are combined. Legal Definition of tax-deferred. The gain may be taxable in the current year.

1 See definition of Exchange Period in glossary for further details IDENTIFICATION RULES Three Property Rule. More What Is a Reverse Exchange. Common examples of tax-deferred income fall into two broad categories.

The 1031 Exchange allows you to sell one or more appreciated rental or investment real estate or personal property relinquished property and defer the payment of your capital gain and depreciation recapture taxes by acquiring one or more like-kind properties replacement property. Tax deferred is an instance where investment earnings such as interest dividends or capital gains accumulate tax-free until the payment of taxes related to the investment is triggered by some taxable event in the future. The formal rules for a QI are defined in Treas.

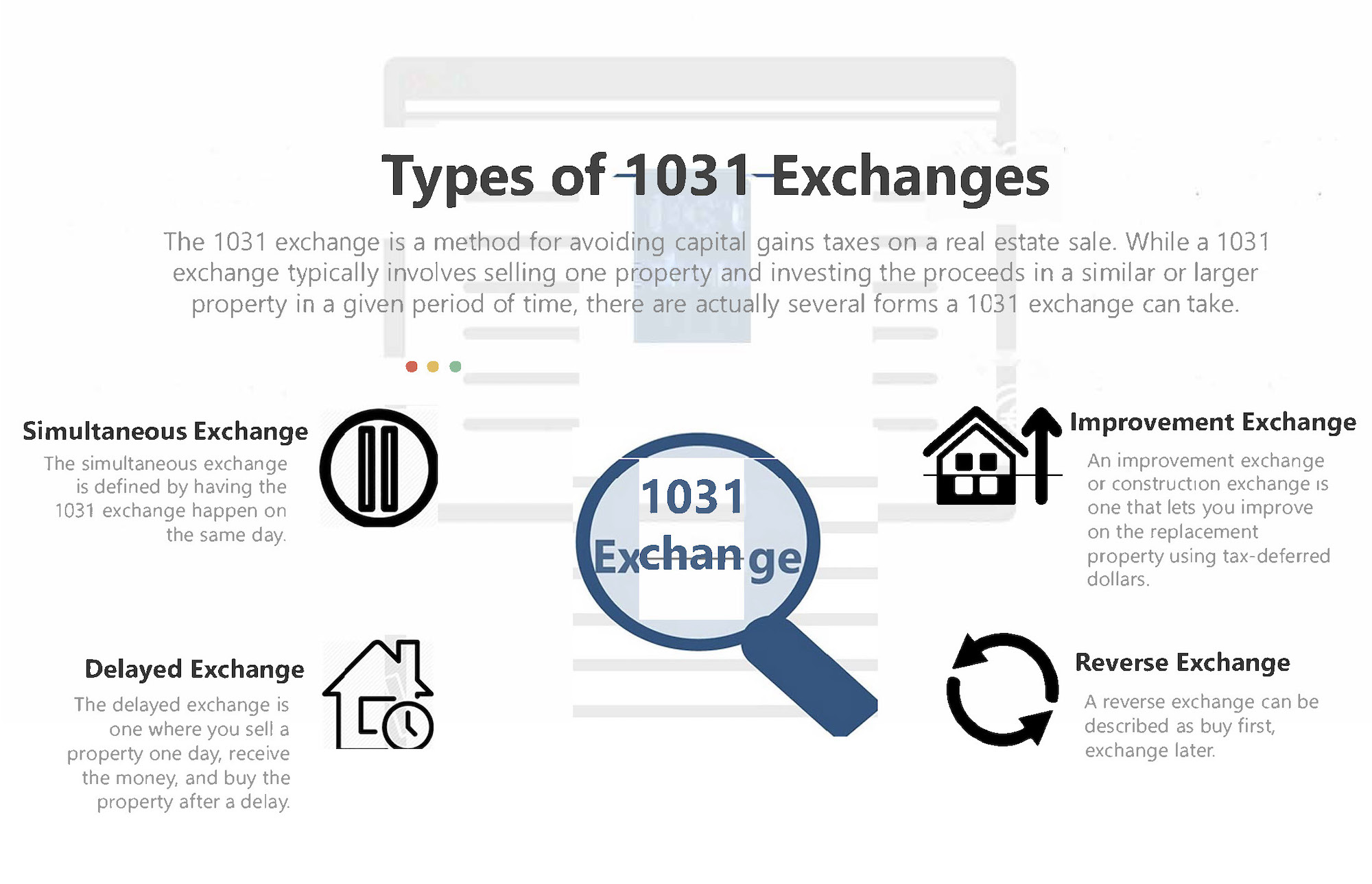

A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring the payment of federal income taxes and some state taxes on the transaction. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.

This is a procedure that allows the owner of investment property to sell it and buy like-kind property while deferring capital gains tax. Deferred 1031 exchanges are. The QI creates legal distance between you and your 1031 transactions by.

In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property. This is the. A tax-deferred exchange in which one asset is exchanged for a similar asset of the same nature character or class.

1031 Tax Deferred Exchanges allow you to keep 100 of your money equity. A 1031 exchange otherwise known as a tax deferred exchange is a simple strategy and method for selling one property thats qualified and then proceeding with an acquisition of another property also qualified within a specific time frame. The account holder is not liable for taxes until funds are disbursed.

The Legal Information Institute wrote a solid technical answer. An investor benefits from the tax-free growth of earnings with tax-deferred investments and if held until retirement the tax savings can be substantial. After the relinquished property closes the exchanger has 45 days.

Specifics of a Deferred 1031 Exchange. Tax-deferred exchanges cannot be used for personal-use properties and under new laws enacted in December 2017 only real property qualifies for a 1031 exchange. A Qualified Intermediary QI helps taxpayers facilitate tax-deferred exchanges under Internal Revenue Code 1031.

Tax-deferred status refers to investment earningssuch as interest dividends or capital gainsthat accumulate tax-free until the investor takes constructive receipt of the profits. A properly executed 1031 Exchange may allow investors to defer State and Federal income taxation upon the sale of appreciated real estate thereby preserving equity and potentially maximizing total return. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

The taxpayer may identify up to three properties of any fair market value and purchase any or all of them regardless of total value. By completing an exchange the Taxpayer Exchanger can dispose of investment or business-use assets acquire Replacement Property and defer the tax that would ordinarily be due upon the sale. Not taxable until a future date or event as withdrawal or retirement.

On this page youll find a summary of the key points of the 1031 exchangerules concepts and. Deferred tax assets and liabilities are measured at the tax rates that are expected to apply in the period when the asset is realised or the liability is settled based on tax rates and tax laws that have been enacted or substantively enacted by. Although the numbers and the properties differ this is the type of question.

Real estate investments may defer certain taxes including capital gains and depreciation recapture via a 1031 exchangeNote that tax deferral does not. This keeps the entire series of actions as one transaction which makes it eligible for a 1031 exchange albeit a deferred one.

Are You Eligible For A 1031 Exchange

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

1031 Exchange Rules How To Do A 1031 Exchange In 2021 Jones Hollow Realty Group

What Is A 1031 Exchange Properties Paradise Blog

What Is A 1031 Exchange Asset Preservation Inc

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit